Investors are on a rollercoaster ride and not the fun kind with the U.S. stock market under extreme volatility amid heavy selling as President Trump stands firm, wielding his broad tariff strategy against most of our trading partners.

Bear Markets & Correction Territory

The S&P 500 briefly hit a bear market on Monday, following the Nasdaq Composite, which fell into bear market territory or down 20% from its most recent all-time highs on Friday. The Dow Jones Industrial Average is shy of its own as of Monday’s close.

This as the CBOE’s Volatility Index, or VIX for short, which measures volatility, spiked to the highest level in 5 years, hovering at a level of 46.

Don’t Panic

While unnerving for many Main Street investors watching their portfolios, 401(k)s or retirement accounts, selling into a selloff is a big no-no for long-term investors.

“You never sell in a panic, you never ever sell in a panic” said Ken Fisher, founder, Fisher Investments which oversees $295 billion in assets, during an interview on Varney & Co.

Panic Selling Will Cost You

Those who may engage in panic selling will lose out when the market rebounds, according to an analysis by Fidelity shared with FOX Business.

For example, $10,000 invested in the S&P 500 from January 1, 1988 through December 31, 2023, would miss out on gains of more than $264,000 by missing just the best five days of investing.

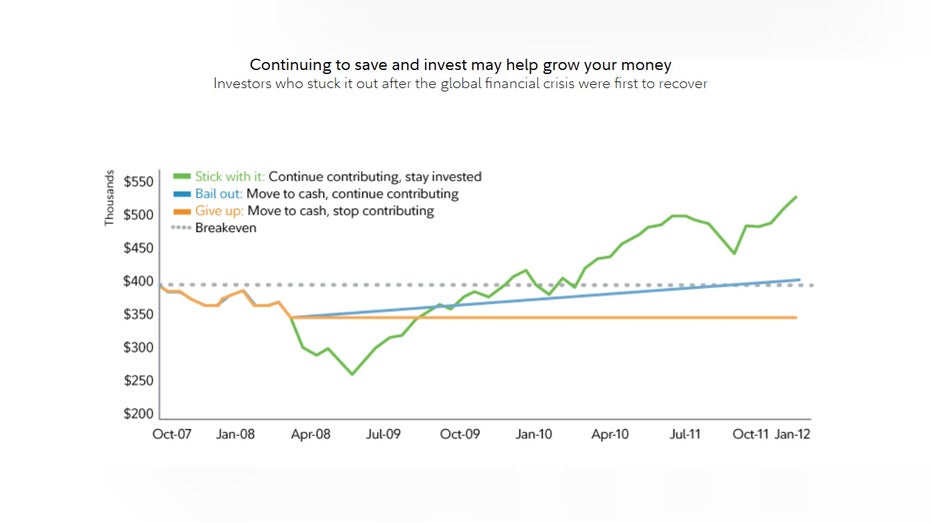

Furthermore, the firm notes that “Historically, every severe downturn has eventually given way to further growth” with the firm showing hypothetical decisions made during the Global Financial Crisis from 2007 through 2012 for a portfolio with a 70% stock/30% bond mix and an account balance of $400,000 and a workplace contribution plan of $15,000.

“It took 52 months for investments to return to the highs set before the Global Financial Crisis” Fidelity wrote. Those who stayed the course saw their account balance rise by about $500,000. Those who moved to cash and stop contributing saw their balances drop to around $350,000.

“You are seeing target prices being dropped for the year, earnings estimates being dropped, the whole gamut. I think it’s good to buy in times of fear like this. This is when the risk is probably less and the upside is greater” said Jim Paulsen, former Chief Investment Strategist at Wells Fargo.

State of Play?

That said, the tariff push is in its early days and its unclear when and how the dust will settle. Firms including Goldman Sachs and JPMorgan have dialed up their chances of a U.S. recession with JPMorgan CEO Jamie Dimon delivering a warning on Monday.

FED CHARI POWELL SAYS TARIFFS LIKELY TO CAUSE INFLATION TO RISE, COULD BE PERSISTENT

“As for the short-term, we are likely to see inflationary outcomes, not only on imported goods but on domestic prices, and input costs rise and demand increases on domestic products. How this plays out on different products will partially depend on their substitutability and price elasticity. Whether or not the menu of tariffs causes a recession remains in question, but it will slow growth down,” he wrote in his annual letter to shareholders.

READ MORE FROM FOX BUSINESS

Last week, Federal Reserve Chairman Jerome Powell reiterated a similar sentiment.

Read the full article here